System Differences - Creation of Trade Debtors/ Creditors Original Accounts

Causes of Out of Balance

There are three main reasons why an out of balance occurs are:

- Journal, transaction or open balance to a header account (Trade Debtors/Trade Creditors).

- Deposit against a quote.

- Prepayment against invoice.

1. Out of Balance due to Journal Transaction or Open Balance on Header Account

The MYOB Company Data Auditor allows you to compare transactions (eg invoices) with the header account (eg Trade Debtors). Run a review for the period that you want to reconcile.

A Tick indicates that the reconciliation was successful and a Question Mark indicates that there are transactions that you need to review. Click on the Question Mark to see the transactions that may have been in error.

The first item “RECONCILE INVOICES WITH LINKED RECEIVABLES ACCOUNT” has a question mark.

When reconciling Accounts Receivables, the total from your outstanding customer balances (eg the total of all the invoices) should equal the total in the Trade Debtors account. Here there is no ‘Out of Balance’.

JOURNAL Reason A: Transaction Directly Entered to a Header

A common cause of ‘Out of Balance’ is when the invoice is created, a Receivables header account is selected, instead of an Income account. A RECAP shows that the amount has been posted twice to the Trade Debtors account.

Sometimes, accountants will post directly to the Trade Debtor/Creditor accounts using in a General Journal. This does not create a corresponding invoice and therefore MYOB will be ‘Out of Balance’.

Another example is when a Customer Payment is entered with the Receive Money window, and the Trade Debtors account is chosen, instead of an income account or the invoice being paid under the customer account.

Another problem occurs when Finance Charge Transaction and the Finance Charge Payment are not both removed when an invoice is removed.

JOURNAL Reason B: Open Balance Setup Not Correct

In MYOB the easiest way to see if the Opening Balance was not correct is the following procedure:

1. Setup > Easy Setup Assistant

2. Sales (or Purchases)

3. Historical Sales (or Historical Purchases)

4. Look at the bottom to find the out of balance figure.

Either the invoices entered are incorrect or the balance sheet balance of Trade Debtors is incorrect.

Jet Converts Fix for Journal – Header Account out of Balance

If your Trade Debtors/Trade Creditors accounts had transactions in it that were not invoices or credit notes to import these transactions into Xero the following changes will have had to be made:

We create the 'Trade Debtor/Creditor' as the system account for Accounts Receivable/Payable in Xero. In addition, we create additional accounts called 'Trade Debtor/Creditor Original'. The system accounts called Trade Debtor/Creditor is where you will add your invoices, bills and credit notes moving forward. The Trade Debtor/Creditor Original contain the direct entry transactions or deposits which did not conform and require additional post-conversion work.

We split the amount in the different accounts so that the out of balance amount stays in the original account and the invoices/bills actually match the balance in the new system account for Trade Debtor/Creditor. When you combine the two account balances these match the source file.

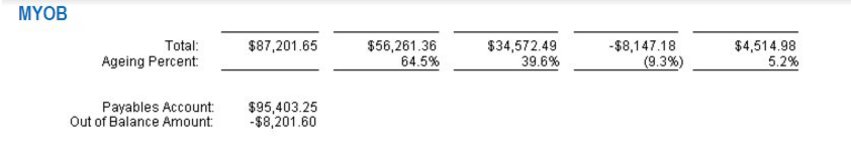

Example: MYOB Payable’s Reconciliation Report

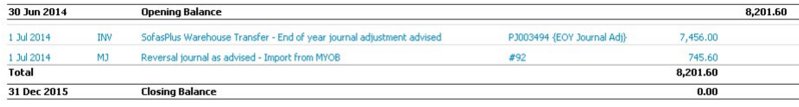

In Xero: We enter the ‘Out of Balance’ amount into Trade Creditor Original account

If direct entries are identified these transactions will also be in the Trade Creditor original account and this will automatically offset the opening out of balance.

If this has also occurred in the Trade Debtors account similar actions would have been taken during the conversion. If there is a remaining balance in the Trade Debtor / Creditor original account then you will need to investigate and allocate post-conversion.

Once the Trade Debtor/Creditor original account(s) is balanced to $0 we recommend archiving and using Xero’s system account for the invoices, bills and credit notes.

2. Out of balance due to Deposit Paid on an Order

A deposit paid on an order will result in a payment before the invoice is created. An order does not have a debit and credit entry and is not structured like an invoice. An order is just a flat document and does not comply with accounting rules. Deposits paid on orders in MYOB at the time of conversion will result in an Out of Balance.

Jet Convert Fix for DEPOSIT Paid on Orders

During the conversion process our conversion tool will go through the information in the chart of accounts and identify any account that has been ‘linked’. For example ‘customer deposits’ and ‘trade debtors’’. In some accounting systems, you have the ability to apply deposits against orders in Xero you cannot. During the conversion ‘orders’ are converted as ‘draft invoices’ and any ‘deposits’ are created into Credit Notes. Using the example above the Conversion Process creates a Credit Note for the amount deposited, eg $150. There will be a separate Credit Note for each Deposit and Contact.

In Xero, you will need to determine if the order should stay in Draft, be deleted or need to be approved (processed). If the deposit needs to be allocated against an Invoice in Xero you can complete the following:

-

- Identify the draft invoices that need to be approved

- Approve the draft Invoice so that this now appears in ‘awaiting payment’

- Allocate the Credit Note against these relevant invoices

- Identify the draft invoices that need to be approved

If you prefer to have your deposit account separated then you can complete the following:

-

- Re-Create the deposit account in the Chart of Account

- Transfer the balance from the Trade Debtor/Creditor to the relevant deposit account

- Re-Create the deposit account in the Chart of Account

Note: There could be a “deposit out of balance” issue. This can happen if your deposit account is not balanced to all open deposits against orders. If it is balanced, it will be $0 and all deposits show up as credit notes.

Note: There could be a “deposit out of balance” issue. This can happen if your deposit account is not balanced to all open deposits against orders. If it is balanced, it will be $0 and all deposits show up as credit notes.

3. Out of balance due to Prepayment – Future/Past Dated Transactions

If an invoice is dated 7th July and the payment against the invoice is 30th June, then we have an Out of Balance if we were to set up the conversion balances as of 1st July. The MYOB Data Auditor will show a report for this.

Jet Convert Fix for Prepayment – Future/Past Dates Transactions

We create a temporary Pre Conversion invoice dated 30th June. The prepayment credit note is offset against this invoice so that at the conversion date, these two balance each other and the ledger is in balance with the control account. We then create a payment dated 1st July, which we match against the Pre Conversion invoice. This leaves the original prepayment to match with the original invoice.

Reports in MYOB

The following MYOB reports can help identify the transactions that cause Out of Balance.

1. Sales > Receivables Reconciliation - to view the amount. Then run this report again with the As At date being 30/12/3000 (or way into the future). If there is no Future Dated transaction, then there is a pre payment.

2. Accounts > Prepaid Transactions. View the Payable out of balances for a series of dates:

1/11/11 = nothing

1/12/11 = 22478.76

31/12/11 = =13815.5

1/1/2012 = 20910.65k

30/6/2013 = -340.45

3. Reports > Accounts > Exceptions > Payables Reconciliation

Allocating Original Account Balance to Invoices/Bills - in Xero

No More Out of Balance!

So to address Out of Balance we first identify the cause in MYOB and fix it as appropriate in Xero. Each conversion is different and there may be situations in which different measures may need to be taken. Please review the Action Checklist that is emailed to you upon delivery of the conversion as this document contains information specific to your conversion. If you do your own conversions you’ll need to consider Out of Balance and how best to manage. Then you can start a “balanced” life in Xero.

Related Articles

System Differences and Transaction Type Issues

When converting your accounting data into Xero, we aim to provide full transactional history if that was the service selection. However, in certain situations, we may only be able to convert limited history, no history or may not be able to proceed ...GST System Differences

There are a number of differences in regards to GST handling that you need to be aware of when moving from one accounting package to another. These can impact you regardless of whether you are converting over yourself or using our conversion service. ...Conversion Clearing Accounts

Due to system differences between accounting platforms, we use clearing accounts during the conversion process to help transfer certain data. These accounts enable us to accurately replicate the financial information from your original software into ...$0 balance invoices/Differences in the GST Reconciliation Report

Invoices that have positive and negative lines that result in the balance of the invoice being $0.00 are captured differently among accounting systems. These are sometimes used to Journal an amount from one account to another without creating a ...Updating the Chart of Accounts in Xero

Updating the Chart of Accounts in Xero The Chart of Accounts can be updated after conversion, and the most efficient way to do this is in bulk. Simply export the chart from Xero, make your updates, and re-import it back into the system. IMPORTANT ...