Jobs / Classes / Categories

Do Jobs / Classes / Categories Convert?

Yes, Jobs, Classes and Categories come across in all conversions if there are less than 100. You can receive up to 500 Jobs / Classes / Categories under the Accelerate premium package. If there are more than 500 Jobs / Classes / Categories in the source data then the transactions will convert but without the Jobs / Classes / Categories, should this not meet your requirements we can create a custom conversion for you.

- We convert into tracking categories, not ‘Projects’

- Cost Centres do not convert

- We do not convert payroll tracking

- Xero does not recommend more than about 200 tracking categories due to potential reporting performance issues. They have a hard limit of 2450 tracking categories. Alternatively, they suggest using an add on to manage.

- We use the total of Jobs (active, inactive and header Jobs) + Categories & Classes to calculate the total number.

- Reckon / Quickbooks Desktop - in some instances, when you create a customer it is automatically added as a Job. If this is the case the Job limitations on all conversion packages will apply.

- If you have more than 500 active/inactive this will be a custom conversion, alternatively, we recommend that you delete the ones you no longer require.

In Xero we convert into Tracking, jobs, classes and categories will sit as a separate "Option" in Xero. Only two options can be active at any one time to include on your transactions.

Jobs/Classes/Categories How do I Work Out If I Have Them?

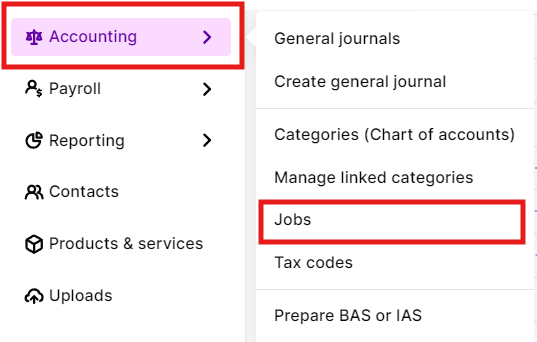

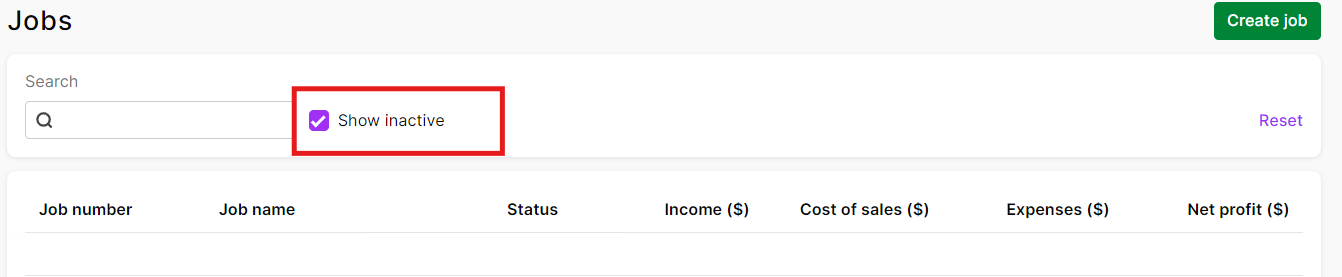

MYOB Online

Accounting > Jobs > Select Show inactive - All Jobs on this page count toward the Job Total

MYOB Desktop

Lists > Jobs

QuickBooks Desktop

- Categories - Lists > Category List (Both active and inactive categories count towards the total)

- Jobs - Customer Center > Right-click on the clients and ensure the Hierarchical view is selected > Ensure All Customers is selected above the list of customers.

When you select a customer on the left-hand side of the screen the right-hand side of the screen will display the details for this entry will appear - this will show one of two things:

- Customer Information - This is a contact and will convert as such irrespective of if you convert jobs. To see if this is set up as a job, open a transaction for this client and check the top left-hand corner of the transaction if the field Customer: Job contains the contact name or is available to select from the drop down then for conversion purposes we are counting this as a job.

- Job Information - this is not a contact and the transaction associated with this Job will be created for the contact it is created under in QuickBooks. If you choose not to convert jobs the link to this job will be lost.

EXAMPLE: Mr Tester Test is the contact and Test is the Job:

How do Jobs / Classes / Categories Convert?

- Descriptions are not brought across ( there is not a field in Xero)

- Any transaction lines that we convert to Xero get the corresponding tracking option (originally job or category) as seen in the source file. Where categories are used in MYOB, we will need to assign them at line level to each transaction, rather than the transaction itself as done in MYOB otherwise you will be unable to report accurately.

- In Xero, a single transaction line cannot be split across multiple jobs therefore we will allocate it to one job only.

- Options in Xero need to be unique so where there are multiple classes with the same name we will add an identifier to make them different and they can be renamed post conversion.

- Job Opening balances are not created in Xero, the tracking commences at the conversion date. You can add manual journals if you require opening balances in Xero. Eg. Applying to a sale - By debiting the chart of account value with no tracking option and then crediting with the appropriate tracking option. This creates and opening balance while not impacting the financials.

- MYOB Online - Allows multi-level jobs. We convert the lowest level as this is what is attached to the transaction line.

- Header jobs will have $0 balances as they are not linked to other Category options in Xero. You can delete these post conversion if you wish.

How Do You Name the Options?

Tracking is grouped into options if you have jobs, classes and categories each one will be converted into an option. Only two options can be active at any one time to code your transactions. We use the Job/Class/Category name from the source file.

Tracking is grouped into options if you have jobs, classes and categories each one will be converted into an option. Only two options can be active at any one time to code your transactions. We use the Job/Class/Category name from the source file.

Below is an example from MYOB showing how the Option Name, Job Number and Job Name convert:

What if My Client Wants to Use Different Tracking in Xero?

This is really easy to achieve if you have more than 500 jobs/categories no tracking will convert and new tracking can be added post-conversion. If you have less than 500 you have two options:

- Convert as is and delete post conversion - Post conversion you can use the find and recode function in Xero. Removing all the tracking from the transactions and then delete the options.

- Delete prior to conversion - If you remove entirely from MYOB they will not convert. Please note in MYOB you need to delete one at a time.

How to Add Tracking in Xero Post Conversion

First add in your tracking options then:

Option 1: Find and Re-code

You can use find and recode to allocate tracking to the necessary transactions. Find and re-code in Xero is a fantastic tool to easily update or re-assign transactions.

Option 2: Monthly Manual Journals

Option 2: Monthly Manual Journals If there are too many transactions to update you could use a monthly manual journal to bring in the tracking information. Please run a job/tracking profit and loss from the source file and then use this to formulate the manual journal to incorporate tracking opening balances.

How to Run Job Tracking Reports

As soon as you receive your Xero organisation you can run a Profit & Loss, Balance Sheet and Tracking Summary report by any job/category.

Xero Help Centre Information on Tracking

Related Articles

Deleting Jobs

Managing Tracking Categories, Jobs, and Classes for Conversion Xero recommends using no more than 100 tracking categories to avoid reporting performance issues. For the Accelerate package, we can convert a maximum of 500 jobs. Xero has a hard limit ...BAS Reconciliation Checklist for Xero

BAS Reconciliation Checklist for Xero Have you recently moved across to Xero and still figuring out how to navigate the software? Wish you had a guide for processing your Business Activity Statement efficiently? We have been working with Xero for ...Inventory Items

All items are created in Xero with their item codes, descriptions and purchase and sales details. What we Convert Item number and item name Base Sales Price Standard cost COGS and Inventory $ COGs and Inventory Accounts Item Description: Note: there ...Using Xero

Paid Bill or Invoice Showing an Amount Due You may find that an invoice/bill is showing as unpaid even though there should be $0 amount due. All of your reports are displaying the correct balances but when you view this particular invoice/bill it ...Other Considerations

Attachments Invoices, PDF's or other documents attached within the source file do not convert. Audit Logs Audit logs are unique to when data is posted in the accounting system so they cannot be brought across to Xero. Bank Rules Bank Rules do not ...