When selecting your service, it comes to your service selection you will be given the choice of a service:

- With transactional history – Ideal if you need historical information in Xero for reporting or referring to past data, OR

- Limited History service – Best for a fresh start or converting messy legacy data.

For a balances (transaction free) service see

here. Continue

below for information on a full transactional history service.Transactional History

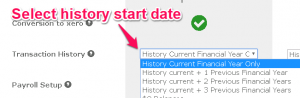

Under the standard package, typically we can convert the current plus the previous financial year of history. With the Accelerate package, you can receive up the the current plus 3 previous financial years. Additional years are available to be purchased during service selection.

See

here for factors that may reduce the amount of history converted. Please note transactions 2013 or prior may not convert.

How Much History?

After upload, the conversion service selection page will display how much history you can receive under each of the packages.

You choose the history start date, and you receive all transactions from that date to wherever the data ends in the source.

Invoices, Bills, Quotes and Orders

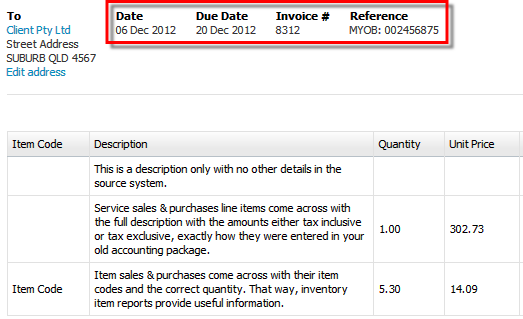

- All open invoices and bills will be converted, unless they are prior to 2013

Including full line item details and all payments against them.

A full and accurate history within Xero means your financial history is accurately reflected, ensuring continuity and no need to go back to the source.

Invoice and customer reference numbers will be converted into separate fields in Xero for invoices. With bills there is only one field available in Xero so the supplier invoice number and the purchase order number will be concatenated, with the invoice number appearing in brackets {} after the purchase order number. Xero will not allow duplicates, duplicates will be given a unique identifier.

Each invoice-line is transferred, including lines with a description only. Item invoices use the correct item codes and quantities. Any original invoice that is entered including tax, will arrive in Xero in the same way.

Quotes are converted as Quotes. The description field on the item level has a 2000 character limit - please note this includes spaces and blank line spaces. Quotes prior to your selected conversion history start date will not be converted. In Xero you cannot apply payments against Orders or Quotes.

Purchase orders convert as purchase orders. The description field on the item level has a 2000 character limit - please note this includes spaces and blank line spaces. Purchase orders prior to the conversion date will not be converted. Item codes do not convert against line items. When Orders are converted to Draft Invoices in Xero the PO Number cannot currently be extracted so you will not see PO Numbers in Draft Invoices.

Item codes come across on approved Invoices and bills. You will NOT receive item codes on credit notes.

During the conversion we cannot allocate ‘Billable expenses’ against Clients in Xero. As a result this information needs to be updated post conversion.

For QBO, QBE, Reckon and MYOB Desktop due to the data mapping process you will lose any zeroes at the start of the invoice number e.g. invoice number 0001285 will appear as 1285 in Xero.

For MYOB Online our extraction tool extracts the first 10 numbers. For example, if the invoice number is IV0000000012345, the first 10 digits are extracted and a unique identifier is added so these can be imported. For Example: IV00000000.1 / IV00000000.2 and so on.

Attachments, recurring Invoices, bills, manual journals, scheduled payments do not come across as part of the conversion. These will need to be set up in Xero following conversion.

Notes for MYOB files: With MYOB Desktop conversions you also receive customer due dates & ABNs.

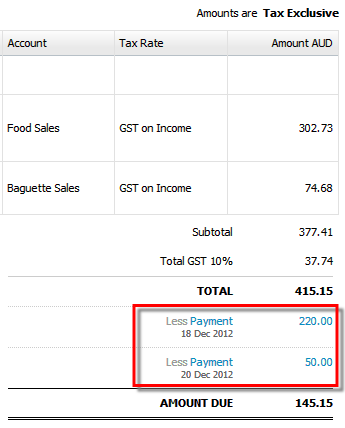

Payments and Credit Notes

Every payment is transferred and applied against the correct invoice/bill. Similarly, each Credit Note is accurately assigned to the invoice/bill on the day that it is assigned in the source file.

Having this detail means you can see exactly when payments and credit notes were made against invoices and bills.

Any overpayments are handled accurately through Credit Notes. So when you enter the next invoice for a client who has paid a deposit, a credit note will automatically remind you of it.

Bank Transactions

Bank transactions will be reconciled according to the source file. All the work previously completed in the old accounting package and is preserved in Xero, meaning, you can continue working from where you finished off.

Reconciled, unreconciled and uncoded transactions

During the conversion we can only import transactions that have been coded, unreconciled transactions convert as unreconciled and reconciled transactions are converted as reconciled. Uncoded transactions cannot be converted as they are not associated with an account.

For unallocated bank transactions in the source file, if there is no chart of accounts assigned against the bank transaction they do not convert. To ensure any uncoded transactions convert you can temporarily assign them all to a holding or clearing account and then recode post conversion. Updates can be completed in bulk using the find and recode function or a manual journal to update post conversion.

Comparing Bank Reconciliation Reports

The Bank reconciliation reports may not match between the source data and Xero if:

- Reconciliation has occurred in the source file after the publication date of the Bank Reconciliation report

- Reconciliation has occurred in the Xero organisation following conversion.

If you want to compare reconciliation reports between the source data and Xero we recommend that you:

- Reconcile to a certain date in the source data and then publish as of that date before sending the file to us.

- Cease all work in the source data file once you have run that report.

- Publish the same Bank Reconciliation report in Xero before starting to reconcile any transactions in Xero.

Note: Xero’s reconciliation reports are dynamic, meaning they reflect current data and cannot be compared retrospectively (unless published).

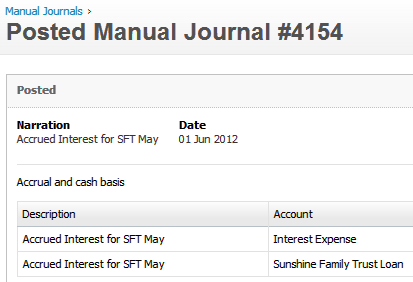

Note: Xero’s reconciliation reports are dynamic, meaning they reflect current data and cannot be compared retrospectively (unless published).Manual Journals

Exactly as the accountant intended.

All manual journals (general journal) details come across exactly as they are entered in the source file with the correct accounts and GST settings.

Xero does not allow bank accounts to be used in Manual Journals and Invoices, so they are replaced by a “Transfer Account” and an additional Spend Money or Receive Money transaction is created.

Xero also does not allow any journal entries to Trade Creditors and Debtors to keep the integrity of the data intact. Any Invoices or Bills that have been paid off via manual journals in the source file will need to be reviewed post conversion in Xero. You may need to apply payments against open Invoices/Bills if they had previously been paid in your source file. The balance in the Account Receivable/Payable Original account can be used to offset the open Invoices/Bills imported post conversion in Xero. If there has been excessive use of journals against system account in the source file we may not be able to complete the conversion with transactional history.

Fresh Start Conversions

If want limited or no transactional history then a Fresh Starts conversion simplifies the process of converting data to streamline your accounting needs. Whether you have messy files, need to upload in bulk, or want accurate results fast, Fresh Starts has got you covered. Read more about the Fresh Start options

here.

Note: Fresh starts are US only at the moment

Note: Xero’s reconciliation reports are dynamic, meaning they reflect current data and cannot be compared retrospectively (unless published).

Note: Xero’s reconciliation reports are dynamic, meaning they reflect current data and cannot be compared retrospectively (unless published).