Limited Transaction Options

If you are starting afresh or have really messy data then a transaction free or limited transactions service is for you. You get to choose which service you want on the service selection page.

$0 Balances

This conversion gives you all the business information and sets the conversion balances to $0 so that you can add them in yourself later. Good if you need some more tidy up before the accounting data in your file is reliable or is not relevant moving forward.

- Contacts

- Chart of Accounts

- Items

- Payroll setup (with $0 balances, all employee details, pay items and templates – Australia only)

- Opening balances set at $0.

You do not get any transactions, invoices/bills (open or closed), credit notes, bank transactions, manual journals or payments.

Current Month Transactional History

This option gives you all the business information and includes the account balances as at the last day of the prior month and all transactions from the start of the current month.

- Contacts

- Chart of Accounts

- Items

- Payroll setup (with payroll balances, all employee details, pay items and templates – Australia only)

- Open invoices and bills (note: if 2013 or earlier they may not convert)

- Transactions from the start of the current month

Uncoded transactions will not convert.

Both of these options also have the option of adding MCBs to them for extended reporting data should you need them.

Please note that if your file is over 350 MB, an additional AU $110 fee will apply due to the extra work involved in converting larger files.

Related Articles

Transactional History

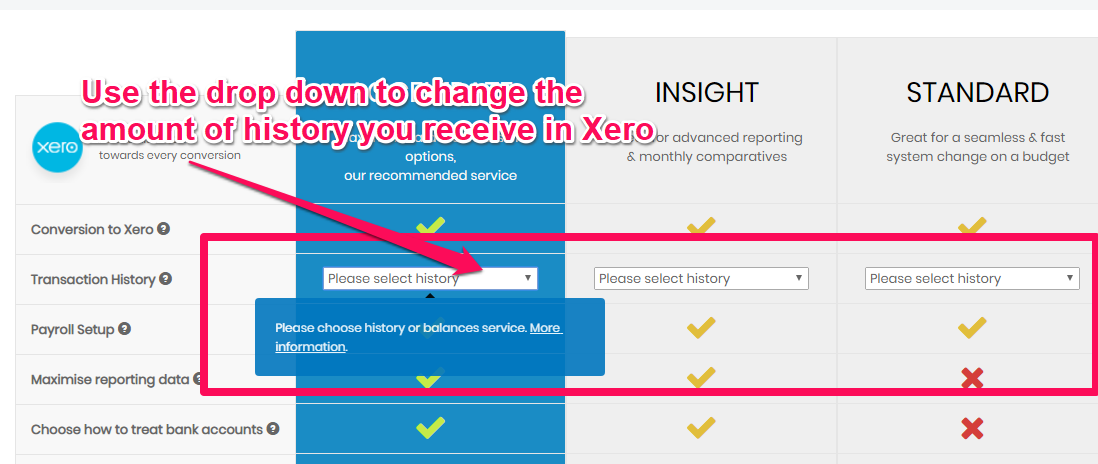

When selecting your service, it comes to your service selection you will be given the choice of a service: With transactional history – Ideal if you need historical information in Xero for reporting or referring to past data, OR Limited History ...Package Options

Notice: As of January 1st 2026, Xero are sponsoring standard conversions into blank Existing Organisations. If you have a Xero Subscription and would like us to convert into it please read more here. Pricing Standard Package Accelerate Package Custom ...$0 balance invoices/Differences in the GST Reconciliation Report

Invoices that have positive and negative lines that result in the balance of the invoice being $0.00 are captured differently among accounting systems. These are sometimes used to Journal an amount from one account to another without creating a ...System Differences and Transaction Type Issues

When converting your accounting data into Xero, we aim to provide full transactional history if that was the service selection. However, in certain situations, we may only be able to convert limited history, no history or may not be able to proceed ...System Differences - Creation of Trade Debtors/ Creditors Original Accounts

When converting information to Xero there are some system differences that need to be taken into consideration. For example, some accounting systems will allow you to create direct entries & manual journals to the Trade Debtor and Trade Creditor ...