Quickbooks Online (US)

What is Converted?

- Contacts

- Chart of Accounts

- Inventory items

- Classes

- Open invoices & bills

- Closed Invoices & Bills for the Transactional Period Converted

- Transactions

Conversion Process

This procedure is for our regular conversion service where we create the Xero Organisation and transfer it to your nominated Xero subscription email address. If you wish to convert into an existing Xero Organisation please see here.

Step 1: Pre-conversion preparation

Some 'tidy-up' work is recommended prior to conversion - refer to our File Preparation page. DO NOT start a Xero organisation as we will create it for you as part of our process. If you wish to convert into an existing Xero organisation please see here for more information.

Turn off bank feeds so that we can perform Quality Assurance prior to delivering Xero to you.

Step 2: Register your details

2.1 Start the conversion via our website.

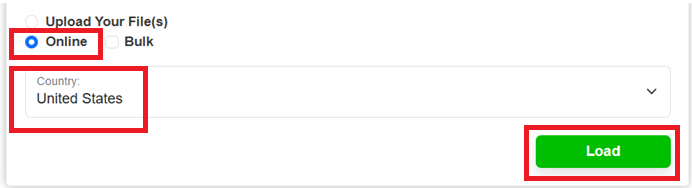

2.2 Select Online, United States, and click Load.

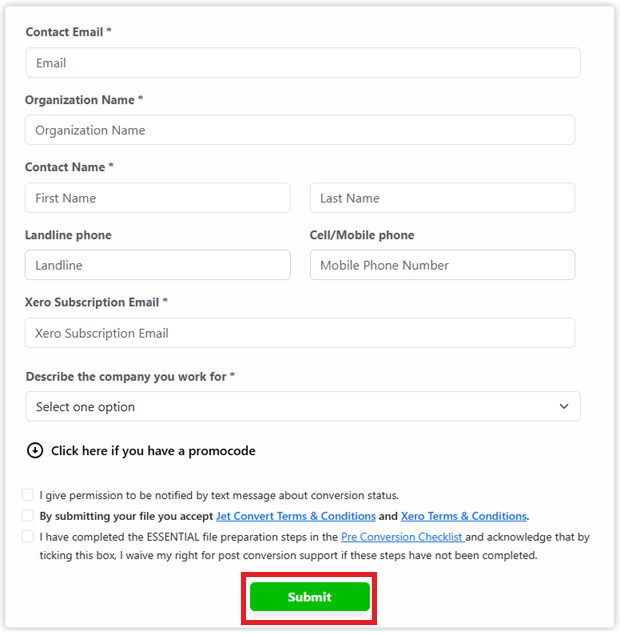

2.3 Fill out your details and click Submit.

Step 3: Grant Jet Convert access to your online company

If you are a Business see here for instructions

If you are an Accountant or Bookkeeper see here for instructions

We request that you do this as soon as possible as the conversion cannot start without your invitation. If you only have a Simple Start Version, please invite us as an Accountant.

We request that you do this as soon as possible as the conversion cannot start without your invitation. If you only have a Simple Start Version, please invite us as an Accountant.Please also note that we cannot convert read-only or QBOs with cancelled subscriptions. The QBO account must be active for us to convert QBO into Xero.

Please note. QuickBooks Online is a live system with bank feeds active. We will do our best to complete the conversion as fast as possible. If you have bank feeds or automatic invoicing then accounts such as AR or AP or bank balances will change daily. We will deliver the Xero organisation based on the status of the QBO data when we gain access to your entity.

Step 4. Select your conversion service

Go to your status page to select your conversion service. This may just be a matter of seconds or may take a few hours, it depends on the data in your file. The options you will be provided will be specific to your file. Select the service and history option that best meets your needs. Then process payment.

Please see here for more on our packages.

Please see here for more on our packages.

Step 5. Client input.

At this point, we have read the source file data and we may require your input to continue, if so we will send you an email. Some of the reasons we might require your input are:

- You Selected a Premium package and need to complete your Bank Account Mapping

- You have Non Standard Tax Codes in the Source File that need to be aligned to Xero standard tax codes .

- You have selected a package that does not accommodate the data in your file and we need your approval on how you would like to proceed.

From here we take up to 5 business days to complete the conversion for Quickbooks Online. Accelerate packages receive priority service so that we deliver as quickly as possible to you.

Step 6. All Done!

On completion of the conversion, you will receive an email with your post-conversion Action Checklist including recommended next steps. It is extremely important that you follow the instructions in this document to get the best outcome with your conversion.

The Xero subscriber is sent an email from @xero.com with a link to take-over the Xero subscription. Click on the link in the @xero.com e-mail and login using the subscriber email provided, or register the subscriber email with Xero if you have not done so before.

Problem transactions in QBO for conversions

Transactions with link to delayed payment

If your transactions have a link to a delayed payment we will be unable to convert transactional history as it is not available through the QBO API. If we encounter these transactions we will need to offer you a $0 balances instead.

Please see screengrabs below for an example of what these transactions look like:

Related Articles

QuickBooks Online (AU)

What is Converted? Contacts Chart of Accounts Inventory items Classes Open invoices & bills Closed Invoices & Bills for the Transactional Period Converted Transactions Payroll What isn't Converted? Multi-currency. AUD must be the only currency. ...Quickbooks Enterprise / desktop (US)

What is Converted? Contacts Chart of Accounts Inventory items Jobs / Categories Open invoices & bills Closed Invoices & Bills for the Transactional Period Converted What isn't Converted?: Multi-currency. USD must be the only currency. Inventory ...How to Grant us Access to Your Online Accounting software - for United States

Source Accounting Software QuickBooks Online For Practices: Navigate to Settings > Your Company > Your Team > Add User. Add First Name = Jet , Last Name = Convert , Email = qbo@jetconvert.com > Next Under Access to your Firm's QuickBooks, select ...How to Grant us Access to Your Online Accounting software - for Australia

Source Accounting Software MYOB MYOB Business/Account Right Live Please ensure when inviting us into MYOB Account Right Live that you are in the browser version of MYOB Account Right Live. In MYOB Business/Account Right Live, click the settings or ...How to Grant us Access to Your Online Accounting software - for New Zealand

Source Accounting Software MYOB MYOB Business/Account Right Live Please ensure when inviting us into MYOB Account Right Live that you are in the browser version of MYOB Account Right Live. In MYOB Business/Account Right Live, click the settings or ...