Quickbooks Enterprise / desktop (US)

What is Converted?

- Contacts

- Chart of Accounts

- Inventory items

- Jobs / Categories

- Open invoices & bills

- Closed Invoices & Bills for the Transactional Period Converted

What isn't Converted?:

- Multi-currency. USD must be the only currency.

- Inventory Quantities - this can be setup post conversion for tracking see here

- Payroll - Payroll movements will be recorded for financial assurance however setup of payroll and employees is not completed.

- Billable Expenses do not convert as Xero does not have the functionality.

Watchouts in QuickBooks desktop for Conversions

- Manual journals to control accounts - More information on how we handle this

- Multiple Accounts Receivable / Accounts Payable accounts - As Xero only allows one we need to merge them.

- Invoices or bills where the chart of account used is a Bank - More information

- Transactions with greater than 1000 lines - more information

- Turn on Chart of Accounts Numbering or we will add numbering during the conversion - more information

- Undeposited Funds - if this is not type Bank account in the source file and is unable to be changed - more information

Getting Ready to Convert

Preparing My QuickBooks for Conversion

See here for our Pre-Conversion Checklist.

How to Back-Up my QuickBooks Desktop File

You only need to provide a backup file if you cannot upload the raw QBW file. To create your backup, follow the instructions in this link or the screenshots below:

NOTE: Please do not take an Accountants backup as these cannot be used for conversion.

1. Open the company file that you want to back up, once the company file is open go to File > Back-up company > Create Local Backup

2. Make sure Local Backup is select and then select Next

3. Select Browse to choose where to save your file once select OK

4. Select Use this Location - as this is a backup for instant upload and not safe keeping there is no issue with saving it on the same hard drive

5. Ensure Save it Now is selected and then select Next

Your file is now ready to be uploaded via our website!

If you have taken a QBB extension backup and there is a password please add the password on the details page.

Condensing a QuickBooks Desktop File

QuickBooks files cannot be purged, but you can clear old transactions with the Condense Data Tool.

Note -

- Make sure you have a backup in case things go wrong.

- If you condense you will not be able to access any of the history removed from the file.

- Please note that if you are successful in getting the file size to less than 800MB it is still a very large file and could take longer than the usual 5 business days to complete. Also, there is no guarantee that we will be able to convert your file, once reduced.

Please see the steps to condense your file below:

- Click "File" in the main menu bar.

- Select "Utilities" followed by "Condense Data".

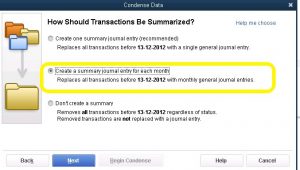

- Click to enable the "Transactions before a specific date" radio button in the Condense Data window.

- Enter your preferred date in the "Remove transactions before" field.

- Click the "Next" button and then click "Next again" to complete the procedure.

- Create a summary journal entry for each month

- Select "Select None" for Removing the transactions, and similarly with not removing the lists (we will need those).

- Begin Condense

Post Conversion Recommended Next Steps

Once you have accepted the Xero Organisation we recommend:

- Reviewing you customise Action Checklist - this will be attached to the email advising completion or you can return to your status page to download a copy.

- Comparing your data for piece of mind - more information

- Do you have an Account Receivable or Payable Originals Account? - get this tidied up - more information

- Updating my Chart of Accounts in Xero - more information

- Setting up your Bank Feeds - more information

- More helpful information on Using Xero

Related Articles

Quickbooks Online (US)

For information on QBO conversions for Australia please go here. What is Converted? Contacts Chart of Accounts Inventory items Classes Open invoices & bills Closed Invoices & Bills for the Transactional Period Converted Transactions Conversion ...What File Types Can and Cannot be Converted?

MYOB Files must be under 800Mb and either .MYO or .MYOX if they are over 800Mb you can use our custom conversions. They must not have Multi-Currency or Multi-locations. Version of MYOB Australia New Zealand Account Right Y Y Account Right Live Y Y ...QuickBooks Online (AU)

What is Converted? Contacts Chart of Accounts Inventory items Classes Open invoices & bills Closed Invoices & Bills for the Transactional Period Converted Transactions Payroll What isn't Converted? Multi-currency. AUD must be the only currency. ...How to Zip Files

How to Zip a File Zipping your file reduces its size and helps ensure a smooth upload. Follow the steps below for your operating system: Windows Locate the file you want to Zip Left-click to select the file. Right click the file and choose > Send To ...MYOB Desktop (AU & NZ)

What is converted? Contacts Chart of Accounts Inventory Items Jobs / Categories / Classes Open Invoices & Bills Payroll Transactional History (dependent on package selection) What isn't Converted? Multi-currency. Native Currency must be the only ...